Home

Wage To Salary Calculator Uk . Uniform tax rebate up to £2,000/yr free per child to help with childcare costs: The latest budget information from april 2021 is used to show you exactly what you need to know.

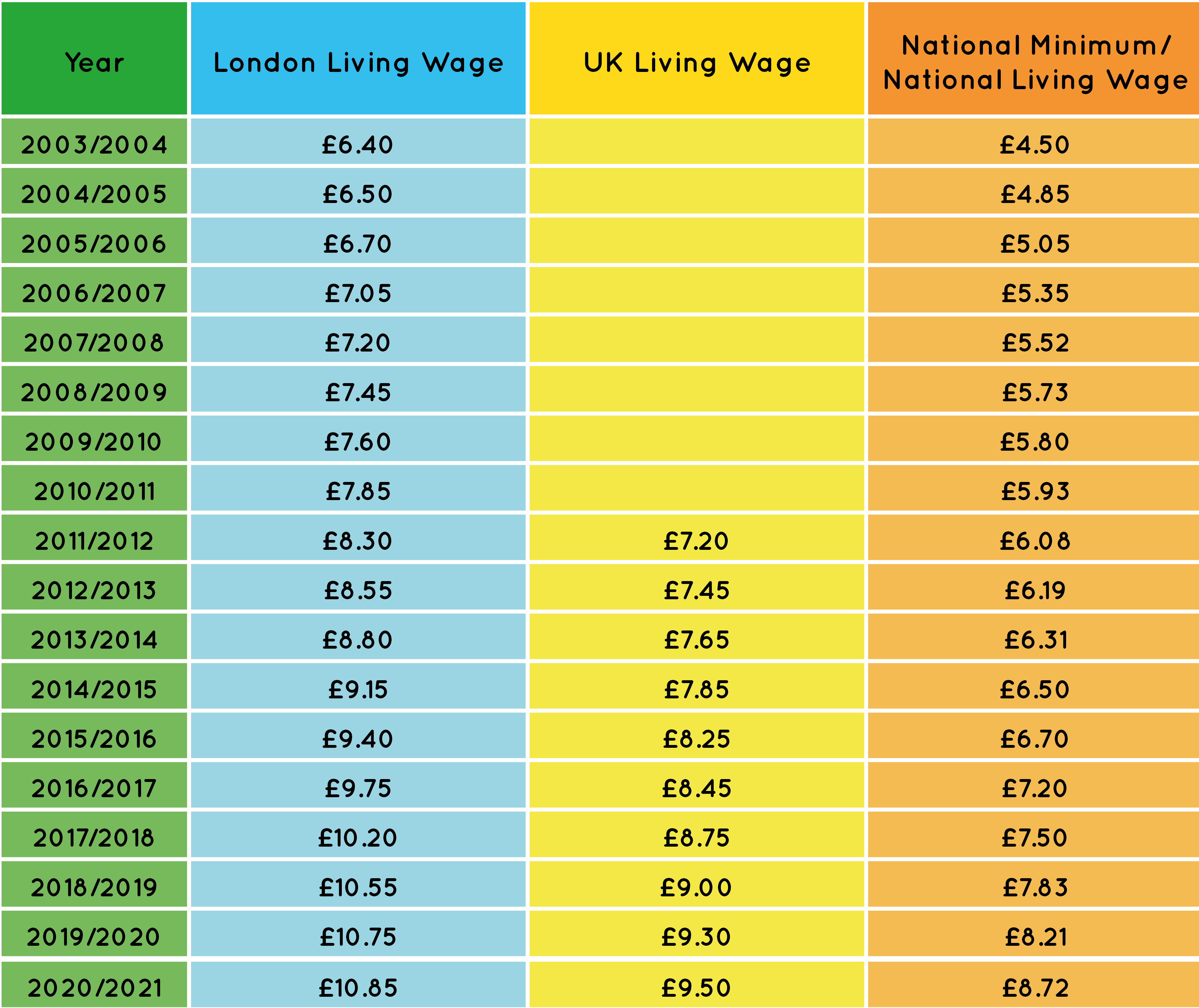

The Calculation Living Wage Foundation from www.livingwage.org.uk Accurate, reliable salary and compensation comparisons for united kingdom The 2020/2021 uk minimum wage (national living wage) per hour is currently: Anything you earn above £150,000 is taxed at 45%. Please note, where a net salary has been agreed the employer will be covering the employee's pension contribution in addition to. Use salarybot's salary calculator to work out tax, deductions and allowances on your wage.

Please note, where a net salary has been agreed the employer will be covering the employee's pension contribution in addition to. Hourly rates and weekly pay are also catered for. After this, you will pay 20% on any of your earnings between £12,571 and £50,270, and 40% on your income between £50,271 and £150,000. Hourly rates and weekly pay are also catered for. Your quote will depend on your individual circumstances so if you would like a personalised quote please contact our new business team. Enter the net wage per week or per month and you will see the gross wage per week, per month and per annum appear. This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations.

Source: i2-prod.walesonline.co.uk More information about the calculations performed is available on the about page. More information about the calculations performed is available on the about page. The average uk salary in 2018 is £30,500 for men and £25,200 for women.

Now you can quickly check your payslips or estimate what your next pay packet will be! The highest salaries in the uk are in the financial services and in the it industry. Hourly rates, weekly pay and bonuses are also catered for.

Use this service to estimate how much income tax and national insurance you should pay for the current tax year (6 april 2021 to 5 april 2022). You can also do salary calculations for every year since 2000! The results are broken down into yearly, monthly, weekly, daily and hourly wages.

Source: lookaside.fbsbx.com Tax calculators and tax tools to check your income and salary after deductions such as uk tax, national insurance, pensions and student loans. £10,000 £20,000 £30,000 £40,000 £50,000 £60,000 £70,000. We strongly recommend you agree to a gross salary.

Why not find your dream salary, too? Use the calculator to work out an approximate gross wage from what your employee wants to 'take home'. Our online income tax calculator will help you work out your take home (net) pay based on your salary and tax code.

Your quote will depend on your individual circumstances so if you would like a personalised quote please contact our new business team. The latest budget information from april 2021 is used to show you exactly what you need to know. Our online income tax calculator will help you work out your take home (net) pay based on your salary and tax code.

Source: www.expatica.com London and cambridge are the places where the highest average wages have been reported in 2018. The 2020/2021 uk minimum wage (national living wage) per hour is currently: You will see the costs to you as an employer, including tax, ni and pension contributions.

Use our calculator to get an estimate of your take home pay these results are based on 40 hours per week and are potential take home earnings. Anything you earn above £150,000 is taxed at 45%. Hourly wage calculator, convert yearly salary to hourly how much is your yearly salary per hour?

Now you can quickly check your payslips or estimate what your next pay packet will be! Updated for 2021/2022, accurately calculating hmrc income tax, salary, paye, national insurance, student loan repayment, and pension contibutions. Work out the maximum wage amount.

Source: www.calculatorsoup.com The tool estimates your net income based on the income tax you will be deducted and the ni contributions you will be required to pay. The 2020/2021 uk real living wage is currently £10.75 in london and £9.30 elsewhere. The median wage per hour in the uk is £15.14 in 2021.

Tax calculators and tax tools to check your income and salary after deductions such as uk tax, national insurance, pensions and student loans. For claim periods from november 2020 to june 2021 this. After this, you will pay 20% on any of your earnings between £12,571 and £50,270, and 40% on your income between £50,271 and £150,000.

Enter the net wage per week or per month and you will see the gross wage per week, per month and per annum appear. Updated for 2021/2022, accurately calculating hmrc income tax, salary, paye, national insurance, student loan repayment, and pension contibutions. Calculate your net salary and find out exactly how much tax and national insurance you should pay to hmrc based on your income.

Source: us.thesalarycalculator.co.uk Hourly rates, weekly pay and bonuses are also catered for. The 2020/2021 uk minimum wage (national living wage) per hour is currently: Please note, where a net salary has been agreed the employer will be covering the employee's pension contribution in addition.

The 2020/2021 uk minimum wage (national living wage) per hour is currently: £10,000 £20,000 £30,000 £40,000 £50,000 £60,000 £70,000. Calculate your net salary and find out exactly how much tax and national insurance you should pay to hmrc based on your income.

To accurately calculate your salary after tax , enter your gross wage (your salary before any tax or deductions are applied) and select any conditions which may apply to. Hourly rates and weekly pay are also catered for. Free tax code calculator transfer unused allowance to your spouse:

Source: images-na.ssl-images-amazon.com The average uk salary in 2018 is £30,500 for men and £25,200 for women. Use the calculator to work out an approximate gross wage from what your employee wants to 'take home'. Our salary calculator builds upon our comprehensive calculation system to provide you with an accurate breakdown of your salary by factoring income taxes, national insurance and other deductions such as student loans and pensions.

The results are broken down into yearly, monthly, weekly, daily and hourly wages. Our salary calculator builds upon our comprehensive calculation system to provide you with an accurate breakdown of your salary by factoring income taxes, national insurance and other deductions such as student loans and pensions. Hourly rates and weekly pay are also catered for.

Why not find your dream salary, too? London and cambridge are the places where the highest average wages have been reported in 2018. The median wage per hour in the uk is £15.14 in 2021.

Thank you for reading about Wage To Salary Calculator Uk , I hope this article is useful. For more useful information visit https://labaulecouverture.com/